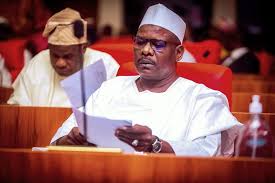

Senator Ali Ndume, representing Borno South in the Nigerian Senate and a member of the All Progressives Congress (APC), has called on the Federal Government (FG) to revise its taxation policy. His message is clear: tax those who can afford it, rather than imposing heavy levies on struggling Nigerians. In his recent statement, Ndume expressed frustration over the lack of accountability from large corporations and wealthy individuals who, despite their substantial means, often evade or underpay taxes. According to Ndume, there is an urgent need for Nigeria to implement a more progressive taxation model that effectively targets those with higher incomes, emphasizing that “you cannot take from who barely has.”

Ndume’s comments reflect growing concerns in Nigeria over the country’s tax system, which has been criticized for disproportionately impacting lower-income citizens. High levels of poverty and unemployment mean that many Nigerians are already struggling to afford basic necessities, making additional taxes and levies feel like an undue burden on the poor and middle class. As Ndume pointed out, Nigeria’s tax policies seem to fail at targeting large corporations and wealthy citizens, who often underreport their income or leverage loopholes to avoid paying taxes.

Nigeria operates a multi-tier tax system that includes federal, state, and local government taxes, including personal income tax, corporate tax, value-added tax (VAT), excise taxes, and import duties. However, despite the presence of these tax structures, Nigeria has one of the lowest tax-to-GDP ratios in the world, sitting at around 6%—a figure considerably lower than the global average. This low ratio signals the extent of tax evasion and avoidance among the wealthier classes and corporations in Nigeria.

One of the major issues contributing to the poor tax compliance of wealthy individuals and corporations in Nigeria is weak enforcement. The Federal Inland Revenue Service (FIRS) faces significant challenges, including inadequate funding, limited manpower, and outdated technologies, which make it difficult to efficiently track and collect taxes from high-income earners and large businesses. Additionally, corruption within some governmental agencies further complicates tax enforcement, allowing powerful corporations and individuals to manipulate the system to their advantage.

Nigeria’s informal economy, which accounts for a substantial portion of the country’s workforce, also makes tax collection a challenge. Many Nigerians earn their livelihood in sectors that are difficult to monitor, and this has led to a tax system that relies heavily on VAT and other indirect taxes, which place a larger burden on the average citizen. As a result, instead of taxing high earners and corporations who can afford to pay more, the government relies on revenue from regressive taxes, which affect lower-income citizens disproportionately.

The widespread practice of tax evasion among Nigeria’s wealthiest individuals and corporations has created a significant gap in government revenue, impeding the country’s ability to invest in infrastructure, healthcare, education, and social welfare programs. Many large corporations underreport profits, shift income offshore, or exploit legal loopholes, depriving the government of critical revenue needed to address the nation’s pressing developmental needs.

According to Ndume, by failing to enforce fair taxation on wealthy Nigerians and large companies, the government is essentially enabling these entities to grow wealthier at the expense of the nation. Large multinational corporations operating in Nigeria are often accused of using complex accounting strategies to minimize their taxable income, effectively reducing their tax contributions. These strategies, including profit-shifting and transfer pricing, allow companies to report lower profits in Nigeria, where tax rates are higher, and to shift them to other countries with lower tax obligations.

Beyond depriving the government of revenue, tax evasion among the wealthy contributes to inequality and social tension in Nigeria. When a small segment of the population accumulates vast wealth while the majority struggle to meet basic needs, the social fabric of the nation is strained. Without fair contributions from those who can afford it, the tax burden falls disproportionately on lower-income citizens, who face increasing costs in the form of VAT and other consumption taxes. This dynamic creates an environment of distrust, as ordinary Nigerians perceive the wealthy as exploiting the system to avoid paying their fair share.

Ndume’s statement points toward a need for a fundamental shift in Nigeria’s tax approach, specifically advocating for a more progressive tax model that ensures high-income earners and large corporations contribute proportionally to their earnings. Progressive taxation is a system where individuals or entities with higher incomes are taxed at higher rates, a model which has been proven to reduce income inequality and provide governments with the necessary resources to fund public services.

To improve tax compliance, Ndume proposes a focus on strengthening tax enforcement mechanisms. This would involve empowering the FIRS with advanced technologies, increased manpower, and sufficient funding to track taxable income more effectively, especially among the wealthy and corporate sectors. Furthermore, ensuring transparency and accountability within revenue-generating agencies could help curb corruption and close the loopholes often exploited by high-income earners.

Ndume’s statement also raises the issue of implementing tax reforms to broaden the tax base by bringing more informal businesses into the formal tax system. Although informal businesses make up a large portion of Nigeria’s economy, many operate outside the tax system due to weak regulation and enforcement. By formalizing this sector and implementing fair, manageable tax rates for small and medium-sized enterprises, the government could generate additional revenue without overburdening low-income citizens.